A.I. pushing Nvidia toward $1 trillion, won’t help Intel and AMD

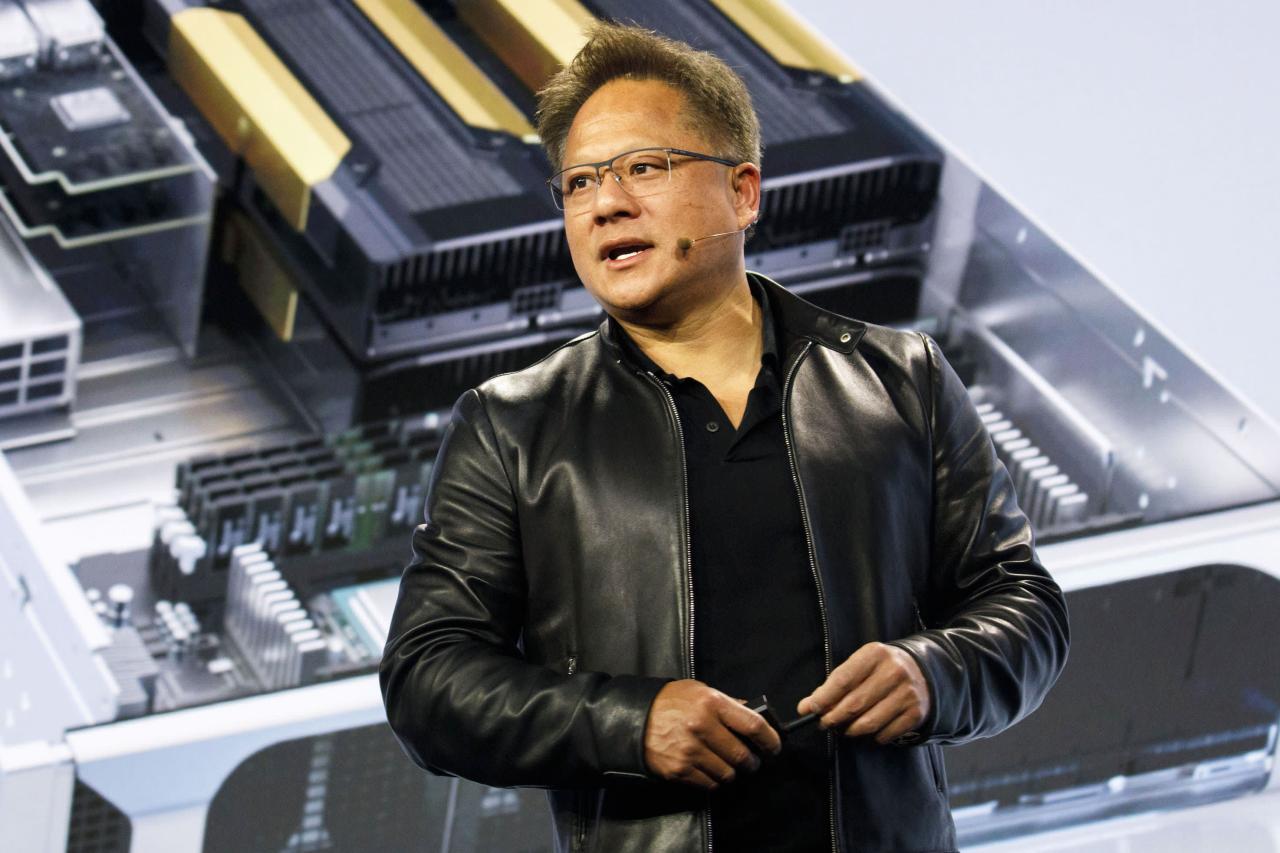

Nvidia’s stock surged during extended trading on Wednesday, nearing a $1 trillion market cap, after the company reported an unexpectedly strong forward outlook. CEO Jensen Huang said that Nvidia was going to have a “giant record year.” The rise in sales is due to increased demand for the graphics processors (GPUs) that Nvidia produces, which are necessary to power artificial intelligence (AI) applications at companies like Google, Microsoft, and OpenAI.

Nvidia expects to generate $11 billion in sales during the current quarter because of the growing demand for AI chips in data centers. This estimate exceeds analyst expectations of $7.15 billion. Huang stated in an interview with CNBC that “the flashpoint was generative AI.” He also shared that historically, the central processor, or the CPU, was the most important part of a computer or server. However, AI applications that require a significant amount of computing power have brought the GPU to center stage. The most advanced systems use as many as eight GPUs to one CPU, and Nvidia currently dominates the market for AI GPUs.

According to Huang, Nvidia is riding a distinct shift in how computers are built that could result in even more growth. Parts for data centers could even become a $1 trillion market. Rather than retrieving data, Huang predicts that the data center of the future will involve generative data, which will necessitate millions of GPUs connected to a lot fewer CPUs. Nvidia’s data center business grew 14% during the first calendar quarter, while AMD’s data center unit had flat growth and Intel’s AI and Data Center business unit saw a decline of 39%.

Nvidia will encounter increased competition as the market for AI chips heats up. Nevertheless, Nvidia’s high-end GPUs remain the chip of choice for current companies building expensive-to-train AI applications. Analysts cite Nvidia’s proprietary software that utilizes all of the GPU hardware features as a significant advantage.

FAQs:

What is Nvidia, and what do they produce?

Nvidia produces graphics processors (GPUs) that power artificial intelligence (AI) applications at companies like Google, Microsoft, and OpenAI.

Why did Nvidia’s stock surge, and what is their market cap?

Nvidia’s stock surged during extended trading on Wednesday, nearing a $1 trillion market cap, after the company reported an unexpectedly strong forward outlook.

What is the reason for Nvidia’s increased sales?

Nvidia expects to generate $11 billion in sales during the current quarter because of the growing demand for AI chips in data centers.

What is the data center of the future, and how will that affect Nvidia?

According to Huang, the data center of the future will involve generative data, which will necessitate millions of GPUs connected to a lot fewer CPUs. Huang predicts that parts for data centers could even become a $1 trillion market, and Nvidia is well-positioned to benefit from this shift.

What is Nvidia’s competition?

Nvidia will encounter increased competition as the market for AI chips heats up. AMD has a competitive GPU business, especially in gaming, and Intel has its own line of GPUs as well. Startups are building new kinds of chips specifically for AI needs, and mobile-focused companies like Qualcomm and Apple keep pushing the technology so that one day it might be able to run in your pocket, not in a giant server farm. Google and Amazon are also designing their own AI chips.

“Nvidia’s A.I. advancements may propel its value to $1 trillion, leaving Intel and AMD behind”

Nvidia’s stock is on the rise and approaching a $1 trillion market cap following the company’s strong forward outlook. CEO Jensen Huang stated that Nvidia is poised for a “giant record year” thanks to spiking demand for graphics processors (GPUs) used to power artificial intelligence applications at major tech companies like Google, Microsoft, and OpenAI. Nvidia is enjoying a unique market shift as AI applications increasingly require GPUs in data centers. Demand has allowed Nvidia to guide for $11 billion in sales this quarter, far surpassing analyst estimates. Huang believes this trend could eventually result in data center parts becoming a $1 trillion market. Historically, central processors have been the most critical part of a computer, yet with AI applications, GPUs are taking center stage. Nvidia currently dominates the market and outperforms its competitors in the artificial intelligence GPU sector. However, as competition steams up in the AI chip market, Nvidia will face significant challenges from the likes of companies like AMD, Intel, Qualcomm & Apple. Yet, Nvidia’s high-end GPUs are currently the chip of choice for expensive to train applications like ChatGPT. Analysts attribute Nvidia’s continued AI chip industry leadership to its proprietary software that optimizes GPU hardware features. Huang argues that the company’s software advantage won’t be easy for competitors to replicate.